Research Title :

Rights and proposals to improve payment using

credit card in Vietnam

CHAPTER II: USING CREDIT CARD &

MERCHANT ACCOUNT

Research Title :

Rights and proposals to improve payment using

credit card in Vietnam

CHAPTER II: USING CREDIT CARD &

MERCHANT ACCOUNT

I. WHY IS CREDIT CARD ACCEPTANCE IMPORTANT FOR BUSINESS?

In the age of information technology, a rich man is not the one that has swollen

pocket of money but the one that has a lot in their account at bank- an e-pocket.

When he wants to buy something he does not pay cash but say "charge it to my

account" and give the seller a credit card. Suppose that all others would do the

same, cash will be no longer needed in such payments and any enterprise that

only accept paper money will soon end up dry. But in the real world, not all the

people have an e- pocket. The number of that varies from country to country -

large in developed country and small in the developing country. In Vietnam

though the people that have a credit card is counted in one hand's fingers,

businesses still need to accept payments not by paper money for payments

without money is an inevitable development in the new economy. Without

acceptance of payments by credit card, company can not have the following

edges in competition:

1. Increase its revenues and profits.

Payments in paper money are now dominating the economy. But this does not

mean the volume of goods and services paid by credit card are small. It is quite

obvious that one who has credit card or merchant account is a rich one. His

spending is sometimes not counted in thousands but in millions. He is in the

upper end in the market segments- that always buys luxury commodities or the

goods and services in the up market.

In business to business transactions, the large amount of settlement, of course,

can not be made by conveying banknote from one local to another or to a foreign

counterpart, but though their bank either by Letter of Credit or Telegraphic

Transfer. Credit card and merchant accounts, especially corporate card play an

important part in those transactions that paper money can not.

E-commerce is growing fast, pushing more and more e-money in circulation.

Without an account we can not make any transactions on lines such as buying the

license of music or software. To buy an essay or thesis on line, for instance, we

must pay from USD 9.5 to 12/ pages not by handling to the web master but by

charging to our account or credit card. So if the company intended to make

money on line must accept payments by credit card or merchant account.

Given that payments by credit card or merchant account have not been popular so

far, companies then get benefits of being the first one that accept that kind of

payments. It is understandable that the first comer in the new area will get the

best parts of the cake for being prestigious for longer time than the new one.

2. Attract more customers, especially foreign tourists and investors.

More and more foreign tourists and investor are coming and staying in Vietnam.

They do not only bring the money in the country but also the habit of payment in.

Payments in Vietnamese currency is really a difficulty as they neither get used to

the currency so quickly nor used to any banknotes but check or credit card.

To develop credit card, particularly international credit card such as Visa card or

MasterCard is the good way to lift that obstacle. This will make them feel

comfortable when staying in Vietnam as they are at home. So surely it will attract

more foreign investors and tourists in. When coming and staying in Vietnam,

their spending will be made mainly to companies, supermarket and shops that

accept payments by credit card or merchant account. It can be easily deduced that

any businesses do not accept credit card will be the loser in this race.

3. Reduce the cost of cash protection and cash transportations.

Cash is the most vulnerable to any robber and dishonest man. When you lost

money, it is sure that the founding is rare but if you lost a credit card your money

still be safe. By using credit card companies do not have to take the risk of

robbery in the transit because the bank that have special equipments take the risk

for you. You only have to take the invoice to the bank and get money back in your

account.

With the help of modern technology one worker can do more efficiently than

they used to. Companies, therefore, can cut down labor cost in some department

such as sales staff and supervisors.

4. Convenient for finance management.

Money is automatically put into companies' account at the end of the day when he

takes the invoice to the settlement bank. No great mistake will be made in

accounting. Companies are also free from being taken capital for customers

paying credit card often make immediate payments not the time one.

5. To create a payment and trade civilization.

Vietnamese are no not acquainted with payments without cash. Everywhere from

buying a small item like vegetables to a fortune one such as motorbike or even a

car, cash is paid directly from the buyer to the seller. When go shopping, he must

prepare a pile of money putting into a swollen wallet, counting before paying to

the seller, and then the seller count again and make the change by counting too

and the buyer count again. So the process goes through four steps of counting and

checking whether the paper notes are false or real. Moreover, the buyer also has

to think of whether the amount taken is enough or more or less. The buyer, for

example, accidentally see something attractive and want to buy but he does not

bring enough money so he must calm down and wait for another chance. All those

things make the buyer less comfortable and sometimes trouble. With a credit

card buyers can avoid all those things and feel free to buy any thing they want

even a car.

By accepting payment on credit card companies also make their company

contribution to trade civilization. Banks must be equipped with new and modern

technology. Others businesses, in competition, also try to become a merchant of

the acquirer. And last, consumers gradually use credit card instead of paper

money.

II. KINDS OF BUSINESSES CAN DO CREDIT CARD AND MERCHANT

ACCOUNT

We can say that nearly all companies can do credit card and merchant account.

They would be wholesaler, retailers, web masters or companies that sell goods

through phone. A little more detailed, they probably be:

Supermarkets,

Hotels and restaurants,

Air and rail ticket offices,

International and domestic insurers,

Post offices and telecommunication service providers,

Petrol stations,

Transports companies such as taxis, lories,

Family furniture stores,

Cosmetic shops,

Beauty salons,

Fashion and shoe shops,

E-commerce Business

Mail Order

Telephone Order

Retail Business

Home based

....

III. RISKS IN USING AND PAYMENT BY CREDIT CARD

In business and at any field, it is very difficult to avoid risks. Issuing credit card

is not out of the rule. The most important thing is that issuers have to research,

analyze in order to limit the risks at the lowest level.

A. Kinds of common risks:

1. Fraudulent Application

By careless consideration the application, the issuing bank issued credit card for

customers without knowing that information in the application form is forged.

This leads to credit risks for the issuing bank when these cards are mature but the

owners don't or are unable to pay.

2. False cards

Base on information of credit transactions and stolen cards, criminals make false

cards. Those cards cause false transactions that make disastrous loss for banks

but most of them are issuing bank. According to the regulations of International

issuing Credit card organization, the issuing banks must take all responsibilities

for all false transactions, which have the code of the issuing banks. This is a

dangerous risk, which is very difficult to manage as it involves in many resources

of information and is beyond the control of issuing Banks.

3. Lost-Stolen Card

The owner often faces to some risks as follow:

- His or her credit card is stolen.

- His or her credit card is lost.

- His or her lost-stolen credit card is used prior to notice to the issuing

Bank for giving measures on taking restriction or withdraw. Some of lost-

stolen cards are benefited for relief painting and recoding by criminals.

Then they can perform false transactions. This risk brings into loss for

both the owner and the issuing bank, which takes account the large part.

4. Never received issue

The issuing Bank often sends the card for the owner by mail but the card is lost

or stolen on the way. The credit card is used meanwhile the real owner did not

know anything that the card had been sent to him or her. In this case, the issuing

Bank will bear the risk.

5. Account takeover

When the reissuing period comes, the issuing bank is informed the change of the

owner's address. As they did not inspect the true of this announcement, the card

is sent to a new address but not the one of the real owner, so that the account of

the owner is takeover. It is only brought out until the owner asks the bank about

his card or receives the copy of debt report for what he did not spent. The owner

and the issuing Bank will share this risk.

6. Mail, telephone order

Accept- payment places provide goods and service under the requirement of the

card owner by mail or telephone, rely on information of the owner: kind of card,

the number, expire date, cardholder's name... but they did not know that his

customers are not the real owner of the card. If this transaction is refused to pay

by the issuing Bank, the accept-payment places must take the risk.

7. Multiple Imprint

When doing transaction, staffs of accept-payment place make more than 2 sets

of invoice intentionally for a transaction but get the cardholder's signature on

only 1 set. Others will be forged signatures of the cardholder in order to receive

money from the bank.

8. Skimming

Criminals use specific device to collect card information on magnetic tape of the

true card. Then they use special device to code and print magnetic tape on false

cards and perform transaction. These illegal activities are increasing in developed

counties making damage for not only the owner but also the issuing and payment

banks.

9. Other risks

+ Unfaithful cardholders: They use intentionally their credit card in different

accept-payment places for payment at lower level than the number allows but the

total amount is higher. Banks find this illegal deal only when they check the

invoice sent by accept-payment places. The bank that issued those credit cards

must be responsible for the risk if the owner can not afford to pay.

The owner may take advantage of international payment to co-operate with others

in letting them using their credit cards in different countries by forging signature

and refusing payment when issuing banks asks.

+ Issuing Banks did not provide prohibited-card list with accept-payment places

when transaction was completed. They must incur losses.

B. Risk management:

To prevent and limit risks, each issuing bank and paying bank must do in

accordance with the process exactly the issuing and payment regulations. Those

processes were issued by issuing Banks based on standard regulations of

International Credit card organization, of each country and the fact of each bank.

Moreover, Banks can take this opportunity to join the international proceeding,

exchanging information and risk management system through effective online

net when they become official members.

+ Cardholders:

- Follow all regulation stipulated on Credit application.

- Get the good hold of usage, keep invoice, payment, dispute and

Complain procedure.

- Keep the secret of the credit card and contact promptly with the

issuing Bank if have something change in the address or card stolen

- Know how to distinguish true card from false one.

Credit cards: to be issued for customers who come up to standard of being

accepted to borrow money from the bank. The cardholders can pay only within

the limit of the credit that has accepted by the bank in written.

When losing credit card, the cardholder have to report in written to the issuing

bank and are not allowed to give the credit card for anyone else for using. Right

after receiving thief report, the issuing bank has to inform to the credit- accepted

places.

IV. WHY HAVE TO ACCEPT PAYMENT BY CREDIT CARD

Together with the development of market economic, international trade and

forms of currencies, number of credit and bank organizations were set up in

order to serve for the demand of goods, payment and social savings.

From the end of century 19th to the begging of the century 20th, followed by the

economic development, the market was not bound to domestic one. Therefore,

banks and credit organizations of each country have to cooperate to create a new

method of payment for all over the world. At the same time, technology and

science in the world got many outstanding achievements in the field of

information, international telecommunication, especially the invention of

informatics. Computer create chances for banks to set up and improve their

method of payment. Among them, the forming and development of credit card

played a very important role in payment

1. Cardholders

- They are freely to use their circulate credit which was issued by the

bank without going to the bank for borrowing money if they pay for the bank

every month.

- Different from other credit, by using credit card, the cardholder can

pay the minimum sum of money once or pay more than this minimum limit

without any penalty from the bank. Generally, cardholders do not pay all at

once although they can afford it. According to statistic, about 80% were not

pay all at once.

- Security: The loss or missing card does not mean loss money. This is

different from cash. When losing cash, it is obvious that losing money.

- By using credit card, the cardholders do not need to bring with him

large money and avoid the risk of losing or missing. That does not include

the inconvenience of paying in cash in foreign countries. Using credit cards

make sure the payment in multi- currencies.

- With computer, the cardholders can buy anything from Internet. It

saves time for customers. They have many chances to choose and buy the

best thing for them. It is obviously that the development of commercial

depends largely on electronic money, especially payment cards.

2. Merchant or Retailer

- By using credit cars as a method of payment, it makes more

convenient and easier for customer in buying anything. That means the

sellers have more opportunities in increase their turnover.

- Expend market for the sellers. Market will become a global one for

the sellers if it is allowed to buy goods through Internet or do commercial

electronic.

- Create a perfect competition environment. Business rival will

compete by various methods of payment. Among them, payment by credit

cards is a helpful way of competing.

- By accepting payment cards, the sellers can reduce the cost of cash

management such as counting, preserving, and sending in the bank's account

to the minimum level. Besides, the payment between the buyer and seller

will be assured to perform rapidly, conveniently and accurately.

3. Banks

- Issuing Credit cards is the easiest way for the bank to develop credit

as well as a convenient way for the borrowers. As the credit limit is

circulating, customers can borrow, pay back and then borrow again without

asking the bank for a new loan. Once, the borrower has paid back, the credit

limit will increase automatically. This means the banks has accepted a new

loan (new credit limit).

- Create chances for banks to expand market and increase customer

without setting up more branches. Moreover, bank deposits will rise

indirectly because both cardholders and sellers get benefit when using

credit cards.

- Increase capital for banks when cardholders and accepted -card unit

have account in the bank.

- Have more services with steady profit, decrease risks.

- Impulse the development of advanced technology in banks to meet the

demand of the industrialization and modernization process in monetary and

finance field.

- Improve the bank's services to create condition for developing other

method of payment.

V. TYPE OF EQUIPMENT

SHOULD BUSINESS USE TO PROCESS

CREDIT CARD

1. For restaurant owner, retailer, or home-based business owner

Terminals:

Terminals are the basic component needed to start accepting credit cards. If

purchasing a terminal as a stand-alone unit, a manual imprinter must be used to

prepare hand written customer receipts.

Terminals and printers in-one:

Terminals and printers in one: a terminal and printer in one can save space and

money and the eliminate the unnecessary cables and power cords. This section

includes battery-powered units, as well as units with cellular systems built in.

PIN pads:

PIN Pads: if you are thinking of adding debit or check verification services, this

is the place to shop.

Printers:

Printers offer convenience and add a professional look to receipts.

Software products:

To sell product over the web, via telephone, or through mail-order, Businesses

need a specialized software package and/or a transaction gateway software.

Online merchants also need a form of shopping cart software. Businesses'll

also need a merchant account to connect their bank, web site, and credit card

processors. The price of a Software product is about USD 200 to 300.

|

Terminals |

|||

|

Product Name |

Price |

Appropriate for: |

|

|

|

The Hypercom T8 is a terminal designed to save you money and time-- pre-programmed keys, single stroke activation, and faster dial response are a few of its features. |

$255 |

Retail and Mail-order Merchants |

|

|

The Hypercom T7E enables a wide range of transactions such as debit, check verification, reports, tip edits, and batches to be accessed with a single clearly labeled key. |

$319

|

Retail and Mail-order Merchants |

|

Terminals and Printers In-One |

|||

|

Product Name |

Price |

Appropriate for: |

|

|

|

The Hypercom T7P is an integrated terminal and printer, featuring a small footprint to save counter space and eliminate clutter. |

$329

|

Retail Merchants |

|

|

The Hypercom T77 has all the same features as the Hypercom T7P, plus the high-speed, easily replaceable printer module. |

$440 |

Retail Merchants |

|

|

$1145 |

Retail Merchants |

|

|

Printers |

|||

|

Product Name |

Price |

Appropriate for: |

|

|

|

The Hypercom P8 Printer is available as either a 40 column friction feed roll printer (P8F) or a 23 column sprocket feed printer (P8S). Both offer bi-directional printing. |

$214 |

Retail Merchants |

|

PIN Pads |

|||

|

Product Name |

Price |

Appropriate for: |

|

|

|

The Hypercom S8 PIN pad is a cost effective solution for all Hypercom T7 terminals. Adding Hypercom's S8 PIN pad allows customers to use their ATM/Debit cards as payment. |

$129 |

Retail Merchants |

Credit Card Authorization and Settlement

2. For Customer-Operated POS Equipment

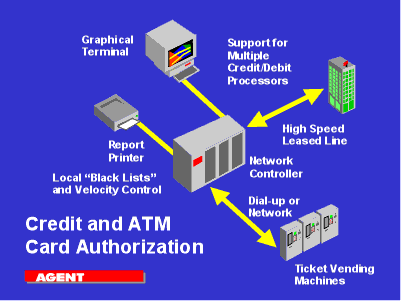

A Complete Networked Solution for Customer-Operated Electronic

Point-of-Sale Systems

The coming decade will see vastly expanded uses of non-traditional payment

systems such as smart cards, customer-operated point of sale devices, and

internet distributed retailing. All of these applications share three (3) common

concerns:

1. Security

(fraud prevention, confidentiality of financial information),

2. Performance (time to authorize and complete a sales transaction), and

3. Cost (both implementation cost and on-going cost of operation).

The Agent Transaction Manager (ATM), for secure, high speed management of

electronic payments, is the only commercially available product that provides

support for both traditional (credit/debit card authorization and settlement) and

emerging non-traditional electronic payment methods on a single platform. It can

quickly implement an electronic payments system using credit/debit cards, smart

cards, or customer operated terminals, gain certification for credit and debit

merchant accounts, and most importantly, keep up-front implementation costs

low.

By minimizing losses through fraud ("charge backs") and by enabling customers

to win the lowest processing fees for electronic transactions, the Agent

Transaction Manager provides the lowest possible operational costs in the

industry.

The Agent Transaction Manager runs on any UNIX-capable desktop,

workstation, server, or mainframe platform, and can grow with businesses. The

multi-platform software systems permits customers to move from one computer

hardware environment to another as their needs change and grow. Scalable

solution allows customers to operate on anything from standalone low cost

Intel-based microcomputers, to distributed networks of high end, fault tolerant

Tandem mainframes, all running the same version of the Agent Transaction

Manager.

Management tools are provided which enable key employees or system

administrators (even those with little or no computer systems experience) to

customize reports and perform normal administrative tasks. The flexible design

of Agent Transaction Manager enables the quick and inexpensive addition of

payment types, new terminals, new processors, and communications links. The

architecture allows the sharing of information processing loads between multiple

servers and front end processors. No project is too big or too small for Agent

Transaction Manager.

High-Speed, Secure Management of Electronic Payments

Agent Systems has been providing electronic payments support to operators of

customer-operated point-of-sale devices. The first projects included movie

ticket vending machines and concert ticket sales terminals. The mass transit

industry has been the home of the largest and most successful users of customer

-operated electronic payment systems.

Fraud-Prevention and Chargeback-Limiting Features

In order for an electronic payments system to be successfully implemented, both

the end user and the merchant must be protected against fraud and security risks.

In the past the electronic payment industry depended upon two important

methods to limit losses:

1) face-to-face contact with a sales clerk and

2) the capture of a signature. Electronic or telephone authorization

systems were created to support these traditional person-to-person

transactions, not to replace them.

As a result, developing electronic commerce applications that do not follow the

classic clerk and customer transaction model have found current credit

authorization systems inadequate. Losses from fraudulent and/or stolen credit

cards and from data collection errors regularly exceed 50% of total sales for

some Internet sales applications.

The Agent Transaction Manager stops losses from fraud before they occur

through "velocity controls" that continuously monitor all sales transactions for

patterns and indicators of possible fraud. Merchants control which indicators and

patterns to monitor, and how to weigh the significance of any element in the

decision to accept or deny a sales transaction. The Agent Transaction Manager

allows merchants to alter these rules, and to create new rules, "tuning" the

application based upon actual experience.

This powerful and flexible system of velocity controls allows merchants to

screen transactions before they are switched through the traditional electronic

authorization system.

VI. TRANSACTION PROCESS

A. Transaction Processing Step-by-Step

1. Customer makes a selection on Self-Service Vending Machine.

2. Self-Service Vending Machine requests authorization through the Agent

Transaction Manager Central Host Computer. PIN numbers for bank debit

(ATM) cards are managed using secure PIN pads on the Self-Service Vending

Machine. Sometimes in larger configurations, an intermediate step is included as

station or regional computers running the Agent Transaction Manager manage

communications traffic between point-of-sale sites and the Central Host

Computer, and process transactions as part of a distributed processing system.

3. After receiving the credit/debit authorization request, the Central Host

Computer performs several anti-fraud measures ("velocity controls"). Velocity

controls (see above) allow merchants to set card transaction limits based upon

total number of purchases, dollar value of purchases, or types of purchases for a

card. Merchants use velocity controls to limit losses from card sales by

identifying purchasing patterns that indicate possible fraud or card abuse. A sale

transaction is only sent to the bank or financial institution for processing if it

passes all local tests defined in the velocity controls.

4. Central Host Computer routes authorization request to proper Bank/Processor.

5. Response is routed by Central Host Computer to Self-Service Vending

Machine. The average elapsed time for a credit/debit card authorization is

between 3 to 5 seconds. The design of the Agent Transaction Manager permits

this response time to be maintained even under peak system usage periods.

6. Record of authorization and transaction is maintained at Central Host

Computer. Redundant records are maintained of all transactions and archived

according to the contractual requirements with each bank or processor.

Administrators are able to inquire on any sale or attempted sale. In this way,

customer complaints of denied sales or non-delivery of product can be answered

immediately using the on-line inquiry facilities of the Agent Transaction

Manager.

7. The Agent Transaction Manager automatically processes the credit and debit

card transaction for deposit, and also provides the merchant with audit

and tracking reports for all electronic funds transfer transactions.

B. Automated Settlement and Reporting

All details of sales made during the sales period are collected at the Central Host

Computer location and assembled into one or several settlement transactions.

All banks and credit card processors have exacting regulations covering all

aspects of credit card processing and the settlement is extremely important.

Agent Transaction Manager submits settlement records using the processes and

formats required qualifying for the very lowest processing rates. Multiple

settlements can be conducted automatically, for example one location for Visa,

another for MasterCard, and another for Discover. If needed, cards of one type,

for example Visa, can be split among two or more settlement processors

according to the issuer of the cards.

The entire process is entirely automated, including the printing of balance

reports and bank deposit records.

Agent Transaction Manager also securely manages the interface to "draft

capture" processors.

[ INTRODUCTION ] [ PART I ] [ PART II ] [ PART III ] [ CONCLUSION ]

![]()